DoshMaster Reviews HSBC’s Zing Multi-Currency App

DoshMaster’s Review of HSBC’s Zing Multi-Currency App

In a bustling market dominated by pioneers like Revolut and Wise, HSBC’s Zing app emerges as a compelling new contender. Launched on January 3, 2024, Zing aims to redefine the way we handle foreign currencies and international payments. Here’s an in-depth look at what Zing offers and how it stands out.

Setup Process

The onboarding process with Zing is astonishingly swift. Registration took merely 15 minutes—a benchmark hard to match by other financial services. The procedure involved a basic ID verification, a selfie video, and a location check, streamlining the entry without compromising on security.

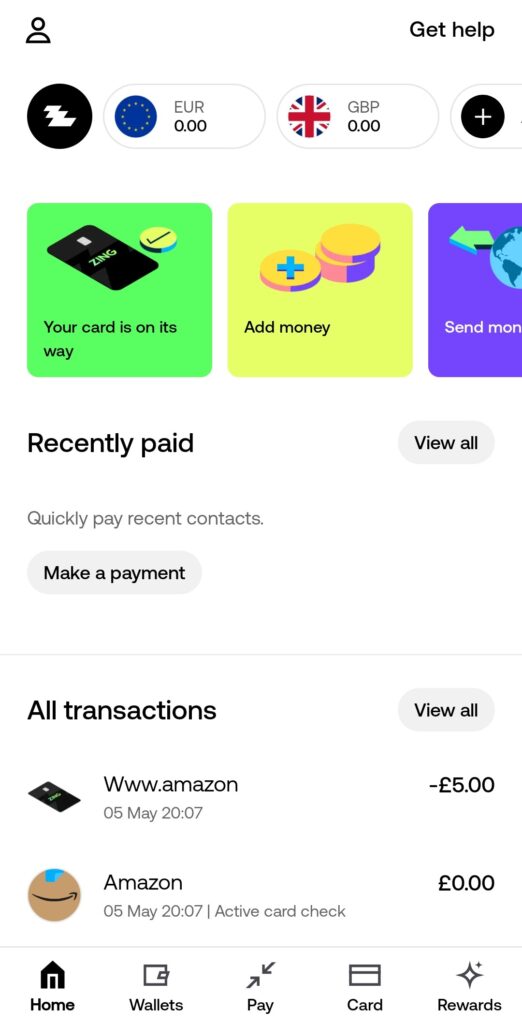

User Interface and Features

Zing’s user interface is clean and intuitive, adorned with pleasant cartoon graphics that make navigation a breeze. The app is not just about aesthetics; it’s packed with robust features:

- Money Transfer: Send money domestically and internationally with no transfer fees in over 30 currencies.

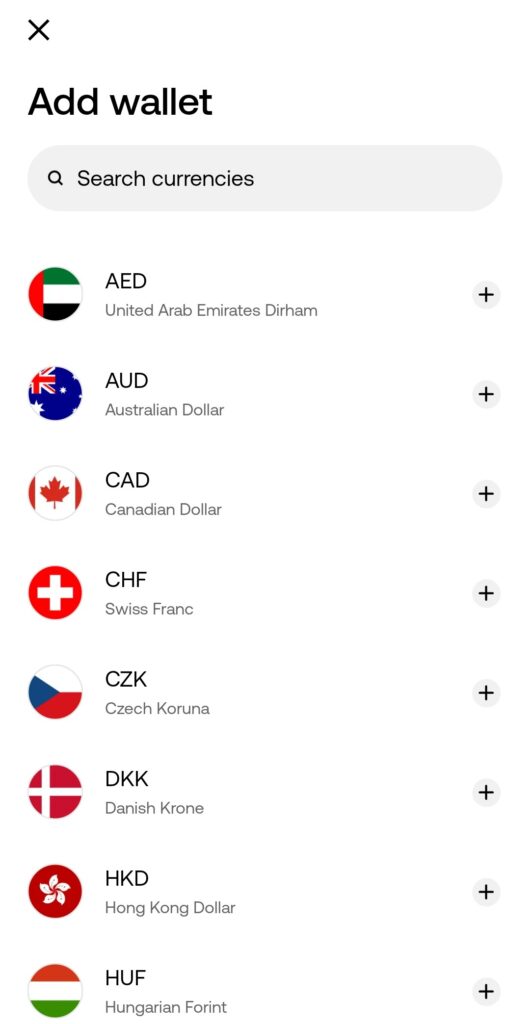

- Multi-Currency Wallets: Hold and manage up to 10 different currencies for free.

- Visa Infinite Card: Spend globally using the physical or digital card.

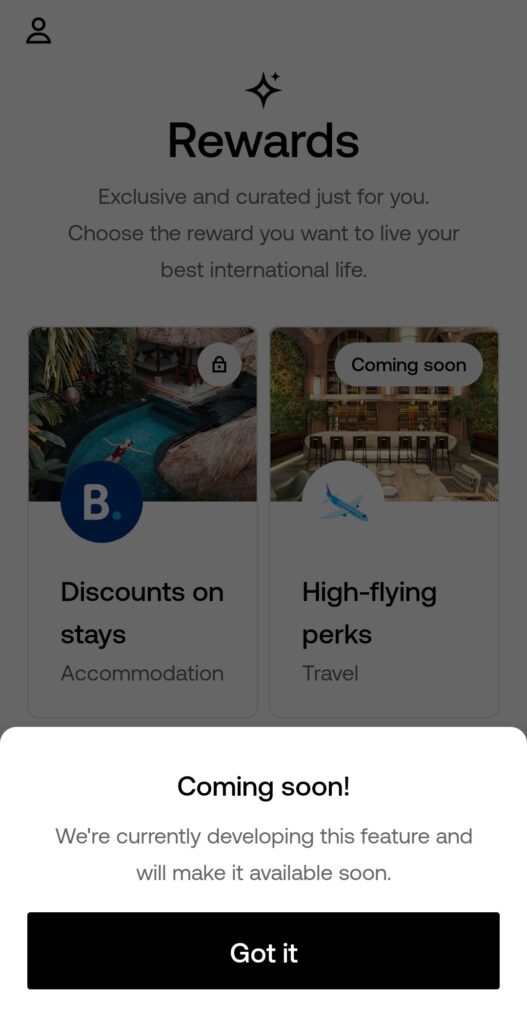

- Rate Widgets and Rewards: Keep tabs on exchange rates and enjoy occasional rewards like discounts on Booking.com.

- Supported Currencies: AED, AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, MXN, NOK,NZD, PLN, RON, SAR, SEK, SGD, THB, USD, ZAR. With more on the way!

Although the rewards section currently shows limited offers, it is expected to expand as the app matures.

Fees and Charges

Zing is aggressively competitive in its fee structure:

- No International Transfer Fees: Zing has eliminated fees on all international transfers, which is a significant boon for users looking to send money abroad without the extra cost.

- No UK ATM Fees: Unlimited free ATM withdrawals in the UK, alongside one free international withdrawal per month, make Zing a strong choice for travelers.

- Low Currency Conversion Fees: At just 0.2%, Zing’s currency conversion fees are markedly lower than the industry average. This rate applies universally, regardless of the currency or the amount, which simplifies budgeting for international transactions.

Advantages of Zing

Zing’s zero-fee model for international transfers and ATM withdrawals places it ahead of many competitors who still charge for these services. The low currency conversion fee is particularly impressive, reducing the cost of spending in foreign currencies significantly.

Final Thoughts

Zing by HSBC is a promising addition to the financial tech scene, especially for those dealing with multiple currencies. While its rewards program is still in its nascent stages, the core functionalities—like fee-free international payments and a multi-currency wallet—make it an attractive option for savvy spenders and global travelers alike.

In conclusion, Zing is not just another app in the fintech arena; it’s a strategic tool designed to simplify and economize your financial dealings across borders. With its user-friendly design and competitive fee structure, Zing stands out as a robust platform catering to the needs of modern consumers. Keep an eye on this app as it evolves, for it surely promises more features and enhancements that will appeal to a broad user base.